Edit Content

Trending

Infosys, for instance, bagged a 10-year deal valued at $1.89 billion from Vanguard, an American investment company, on 14 July 2020. Before the deal was announced, the shares of India’s second largest IT exporter were trading at ₹792.95 a piece. Prices rose nearly 5% to ₹830.95 after market hours on 15 July.

So, what happens when employees, ‘insiders’ in a company, pass on such big ticket deal information to friends and family before they are made public?

This is the story of two friends working in two rival IT giants in Bengaluru. One is a chartered accountant (CA) by training and the other, an engineer. The Securities and Exchange Board of India (Sebi), India’s market regulator, found the duo guilty of profiting from information that is not publicly available—in other words, insider trading—and has banned them from the securities market for a year.

The two central characters of this story are Keyur Maniar and Ramit Chaudhri.

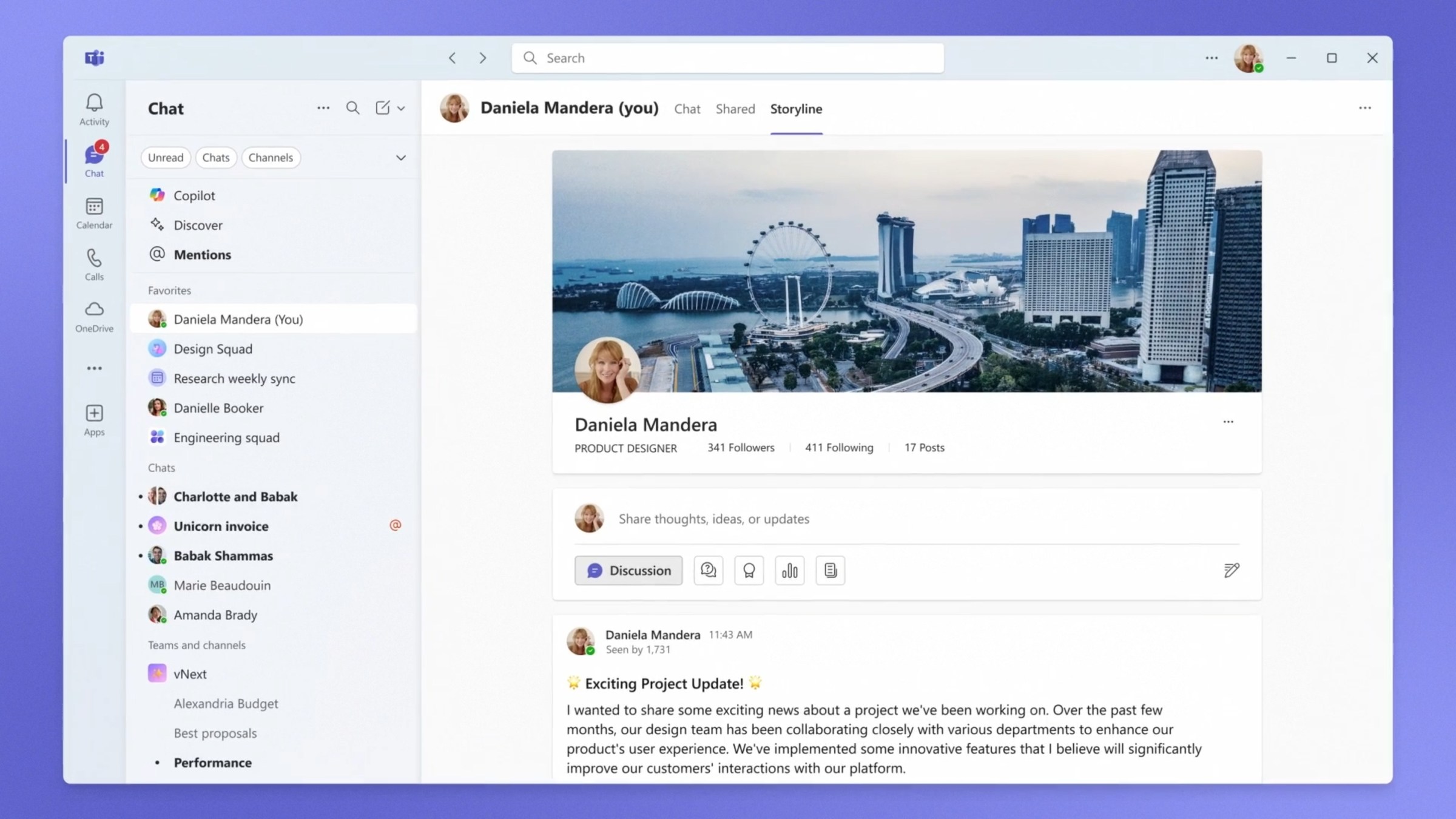

Both worked at Wipro, India’s fourth largest IT services company, between March 2012 and December 2014. Maniar served as Chaudhri’s reporting boss. The two became friends and their friendship continued even after Chaudhri joined Infosys.

While Maniar was a senior vice president at Wipro at the time, Ramit Chaudhri started working with Infosys BPM, a subsidiary of Infosys.

Maniar was part of a Wipro team that bid for the Vanguard contract mentioned above.

IT services firms usually take between 12 and 18 months to close mega-value contracts with Fortune 100 companies (Vanguard Group manages about $9.3 trillion in assets). According to three executives, Infosys and Wipro started work on pitching for this contract, which included managing Vanguard’s software processes for its record-keeping business, early in 2019. According to one executive, Infosys chief executive officer, Salil Parekh, met with Vanguard’s top brass in the last week of February 2020.

By March 2020, Maniar realized that Wipro was no longer in contention.

However, he and Chaudhri, who by now was part of an Infosys team working on the Vanguard bid, continued to discuss the progress of the deal, according to a 93-page order by Sebi’s whole-time member, Ananth Narayan G., dated 31 January this year.

On 25 June 2020, Infosys informed some employees that it had bagged the contract. This included details about what Infosys would be expected to do, the team size, and other information needed for the company to start working on the project.

Four days later, on 29 June, Infosys informed a larger set of employees about the win and said that the company would make this news public in two and half weeks.

In its initial investigations, Sebi found that Chaudhri was among the 1,595 executives who knew the value of the Vanguard contract and the date of the announcement. The market regulator contends that since details of the deal win, including the date of the announcement, were known by 29 June, it triggered the start of what is known as ‘unpublished price sensitive information (UPSI)’.

After analysing call data records between Maniar and Chaudhri and their past work history, Sebi concluded that Chaudhri shared this price-sensitive information with Maniar. “There was a crucial call on 8 July 2020 between Ramit (Chaudhri) and Keyur (Maniar) which went on for almost 20 minutes. Seven minutes after the conclusion of the call, Keyur started placing orders in the scrip of Infosys,” Tarun Agarwala, the Securities and Appellate Tribunal justice, said in an earlier order, dated 30 March 2022.

Simply put, Maniar was betting on the Infosys share price to jump.

Maniar chose call options as his trading vehicle—these are financial contracts that give the holder the right to buy an underlying asset at a predetermined price on a future date.

Sebi found that after Infosys announced the deal on 14 July 2020, Maniar sold half of the call options he had taken. The executive sold most of the remaining half of his call options on 15 July 2020, before Infosys declared its first quarter earnings for the year.

During these transactions, Maniar made a cool ₹2.6 crore profit on an investment of about ₹78 lakh.

View Full Image

The other trading pattern that convinced Sebi about the insider trading episode? Maniar was not a familiar trader in Infosys shares.

“During the week prior to the announcement (i.e. during 8-14 July 2020), Keyur’s trading concentration in the scrip of INFY was 99.6%, whereas his trading concentration during the look-back period, i.e. 20 May 2020 to 1 July 2020 and look forward period, i.e. 29 July 2020 to 9 September 2020 was 0%,” Sebi’s first ex-parte order, dated 27 September 2021, stated.

Look-back and look-forward periods are time frames stock market participants use to examine trends, indicators, and trade patterns. They can range from a few days to months or even years. In Maniar’s case, Sebi’s investigation considered 42 days as the window to examine trades executed by him. An interim ex-parte order refers to a temporary court order that is passed based on information analysed by only one side—in this case, Sebi.

The current Sebi chair, Madhabi Puri Buch, signed the September 2021 order restraining Chaudhri and Maniar from buying, selling, and dealing in securities, either directly or indirectly, until further orders.

Buch was a whole-time member of Sebi and took over as chairperson on 2 March 2022.

It is unclear what caused Sebi to probe this episode. The market regulator says its “internal surveillance” initiated the probe.

“Sebi’s surveillance system flagged unusual trading activity in Infosys shares around the 14 July 2020 announcement of the Infosys-Vanguard deal,” said Sumit Agrawal, a partner at Regstreet Law Advisers and a former Sebi officer. “The Sebi order confirms that the case originated from its alert system, not a whistleblower complaint or an employee tip-off. This triggered a preliminary examination and investigation into potential insider trading,” he added.

Sebi’s surveillance system flagged unusual trading activity in Infosys shares around 14 July 2020. — Sumit Agrawal

What trading data alerted the market regulator’s system?

“In most of the OTM (out of the money) call option contracts, Keyur had created the highest positions just prior to the INFY-Vanguard deal announcement made on 14 July 2020 and had made a significant contribution to total market open interest (the total number of futures contracts held by market participants at the end of the trading day),” reads the Sebi order. “However, he squared off most of these long positions on the next day, even before the announcement of financial results”.

In a long position, an investor buys shares of a company, expecting the price to increase in the future.

Both Chaudhri and Maniar filed their appeals against Sebi’s 2021 ex-parte order before the Securities and Appellate Tribunal (SAT) the same day—27 December 2021.

In his appeal to both Sebi and SAT, Maniar argued that the market regulator could not prove Chaudhri’s involvement in passing the sensitive information to him based on a single phone call between 29 June and 14 July 2020. Claiming innocence, he further added that the phone conversation revolved around Chaudhri seeking a second opinion on his mother-in-law’s cancer treatment from Maniar’s wife, a doctor.

Finally, Maniar claimed that he was not an “insider,” as Sebi concluded, because he did not have access to price-sensitive information or knowledge of the deal’s date.

Chaudhri, on the other hand, argued that all deal expansion plans were not price-sensitive and that there was no connection between the Vanguard deal and Infosys share price rising. He stated that the IT major’s shares were on the upswing since the beginning of 2020.

Sebi did not buy Maniar and Chaudhri’s arguments. It also dismissed that Chaudhri had called Maniar to discuss a second opinion on his mother-in-law’s cancer. The regulator questioned the need for seeking a second opinion after his mother-in-law underwent cancer-related surgery on 6 July 2020 and not immediately after diagnosis, on 1 July. In addition, the regulator found no medical reports that were exchanged between the duo.

Sebi conceded that it could not establish whether Chaudhri also placed bets or received a share of his friend Maniar’s profits. Nonetheless, the regulator concluded that Chaudhuri “committed the egregious violation of conveying the unpublished price-sensitive information pertaining to his company’s announcement of the Vanguard deal”.

View Full Image

While SAT declined to grant relief to the duo, it did observe that restraining both from the securities market for a year without hearing their side of the story was “harsh and excessive”. The tribunal directed Sebi to “listen” to them before passing a final order.

On 31 January this year, Sebi passed the final order, imposing a fine of ₹2.6 crore on Maniar and 12% interest from the day he made his last trade. Additionally, the regulator fined Chaudhri and Maniar ₹30 lakh each. The regulator also retained the ban—the two executives cannot participate in the securities market, either directly or indirectly, for a year.

“Both Maniar and Chaudhri can challenge Sebi’s order by appealing to SAT again. Their appeal can cover all aspects, including the imposed fine and the trading ban,” said Agrawal of Regstreet Law Advisors, the Mumbai-based law firm.

Both Chaudhri and Maniar are no longer employed with their respective companies. Wipro sacked Maniar in September 2021, while Chaudhri left Infosys in April 2021. Mint could not ascertain if Infosys sacked Chaudhri.

Maniar, in his mid-50s, did not respond to a message sent over LinkedIn. Maniar runs Botree Software International, a Chennai-based privately held software company. Meanwhile, a message sent to Chaudhri seeking comment went unanswered. Chaudhri, too, has set up a software firm in stealth mode for now.

An email sent to Infosys and Wipro seeking comment went unanswered.

In a previous order, passed on 26 June 2024, Sebi imposed a penalty of ₹25 lakh on Infosys for failing to establish internal controls that prevented insider trading.

The latest insider trading episode raises questions on how prevalent the practice could be. More importantly, how can other companies look to limit such practices?

Some experts vouch for tougher punishment as an antidote.

“Those indulging in insider trading and making a profit worth crores must not be let off with a small fine worth lakhs. The punishment must be such that it causes a pinch,” said Shriram Subramanian, founder of InGovern Research Services, a Bengaluru-based proxy advisory firm. “Companies must sensitize employees on the perils of insider trading,” he added.

Those making a profit worth crores must not be let off with a small fine worth lakhs. —Shriram Subramanian

We asked professor Venkatesh Panchapagesan, who teaches finance and accounting at the Indian Institute of Management, Bangalore, on the lessons from this case.

“The age-old lesson—it does not pay to be greedy,” he replied. “Here are two senior executives, possibly with a very good compensation package, still trying to earn more. No different from countless cases of insider trading over centuries,” he added.

“This episode suggests that the net of people with whom insider information can be shared to gain an undue advantage is fairly large, and also potentially includes ex-colleagues who now work at a competing firm,” said Anirudh Dhawan, professor of finance at Indian Institute of Management, Bangalore.

Sebi did recently amend insider trading regulations, expanding the definition of ‘connected person’ and broadening certain provisions from ‘immediate relative’ to ‘relative’, thus increasing its enforcement scope.

“However, pre-empting insider trading remains challenging, as detection is typically post-facto through surveillance and investigations,” said Agrawal of Regstreet Law Advisers.

©2024. Livebuzznews. All Rights Reserved.