It has been almost a year since February 28, 2024, when the Securities and Exchange Board of India (SEBI), expressing concerns about potential froth building up in the mid- and small-cap segments, directed mutual fund companies to perform liquidity stress tests on their mid- and small-cap funds and publish the findings on a monthly basis.

The purpose of the stress-test initiative is to educate the average mutual fund investor about the potential risks and the effects of market volatility on the liquidity of their equity portfolio. This awareness enables investors to make informed decisions regarding rebalancing and reallocating their liquidity and savings in a manner that aligns with their financial goals and risk tolerance.

Amid a severe market correction close to or more than 20 per cent across small- and mid-cap funds, over the past five months, it’s an apt time to glean insights from the monthly stress test data. After all, the purpose of the stress tests is to give investors a a good perspective on the risks they are exposed to as volatility takes centre stage.

Here are two important findings to take note of.

Valuations remain high

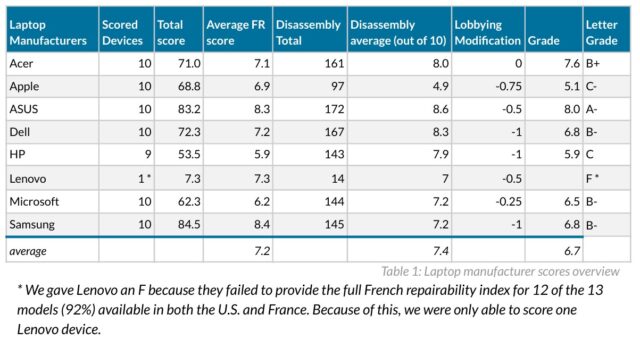

As per the disclosures, the average trailing 12-month PE ratio of small-cap fund portfolios rose to 31.8 in January 2025, up from 30.2 in February 2024. It has, of course, cooled off from a high of 36.2 times when markets were at their peak in September 2024. Similarly, the mid-cap funds category has witnessed an increase in the last one year, with the ratio climbing to 34.5 from 31.9 last year, while it is down from 42 times in September.

A surge in retail participation with domestic flows has been a major factor driving the rise in mid- and small-cap valuations. During the above-mentioned period, the mid- and small-cap funds attracted net-inflows of ₹37,389 crore and ₹36,687 crore respectively.

Top mid-cap funds that saw significant spike in their portfolios’ trailing 12m PE were HSBC Mid Cap (from 24.9 to 59.6), Motilal Oswal Midcap (from 51 to 62) and Invesco India Midcap (from 34.5 to 43.4). Top three that saw significant increase on the small-cap side were Tata Small Cap (from 21.7 to 34), Bandhan Small Cap (from 20 to 31.5) and Union Small Cap (from 30 to 41).

Tightening liquidity

Two-thirds of the small-cap funds experienced an increase in the number of days needed to liquidate 50 per cent of their assets, whereas fewer than one-third of mid-cap funds saw a rise in the time required to liquidate 50 per cent of their assets. It indicates tightening of liquidity especially in the small-cap space. Also, the schemes with larger assets saw an increase in the days to liquidate their assets.

A scheme’s liquidity is crucial, as it reflects how swiftly it can sell its holdings in the market to raise cash, ensuring it can meet unexpected redemption requests if a large number of investors seek to withdraw their funds.

The average time required to liquidate 50 per cent of small-cap fund portfolios rose from 14 days in February 2024 to 16 days in January 2025. Meanwhile, mid-cap funds experienced a more moderate increase, with the average liquidation time for 50 per cent of their portfolios edging up slightly from seven days in February 2024 to eight days in January 2025.

Mid-cap space, funds with larger asset size that saw significant increase in the period to liquidate 50 per cent of assets were HDFC Mid-Cap Opportunities (from 23 to 47 days), Quant Mid Cap (from six to 21 days) and SBI Magnum midcap (24 to 35 days). Among the small-cap funds with larger size that saw significant surge were Quant Small Cap (from 22 to 51 days), HDFC Small Cap (42 to 60 days), DSP Small Cap (32 to 48 days) and Nippon India Small Cap (27 to 36 days).

Investors should be aware that the time it takes to liquidate a portfolio is not necessarily an indicator of its quality. These outcomes should be evaluated alongside the quality of the stocks within the portfolio. Additionally, this is based on a hypothetical stress-test scenario where trading volumes are assumed to triple, and market participation is limited to 10 per cent (as per the SEBI methodology used here). It’s important to recognise that actual market conditions may differ significantly from this simulated environment.

Nevertheless, these data points have information that investors must take cognizance of in their investment decisions.

Takeaways

The data indicate the risk that investors in mid- and small-cap funds face, in the case of an adverse market event. Despite recent correction, valuations remain high. When valuations are high, the margin of safety is lower for investors.

Two, the tightening liquidity reflects the pressures that unit prices will come under in case of redemption pressure. With flows strong, funds have not faced any redemption pressure. But a combination of tighter liquidity and high valuation, implies drawdowns can be more severe, recent correction notwithstanding.

Of course, the real life situation can be better or worse than what the stress-test data indicate.

For a very long-term SIP investors, this may not matter much and in fact any deep correction would actually be an opportunity for them to accumulate more units at lower price levels. However, if you are an investor who may be looking to exit your investments in a year or two and hence risk propensity is low, you must take cognizance of these and make prudent decisions.