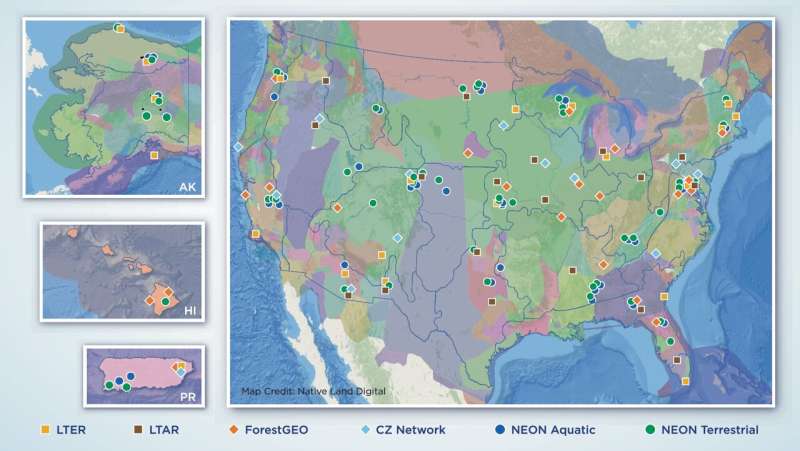

The Finance Minister, in her Budget 2025-26 speech, announced that the new Income-Tax Bill will be laid before Parliament in the next one week, and that the text will be clear and direct. KPMG conducted a survey to understand industry’s views and expectations from the simplification exercise (see graphic).

The survey results brought out some interesting expectations from taxpayers. When asked about top three areas that require attention, 84 per cent of the respondents mentioned simplification in the area of assessments/disputes as one of their top choices.

The survey also shows that almost 99 per cent of the respondents want the government to introduce a mandatory timeline for disposal of pending appeals before the Appellate Commissioner level [CIT(A)].

This feedback appears to be triggered by the huge pendency of cases before the CIT(A) forum. Per the recent report of the Standing Committee on Finance (December 2024), the disputed demands have been quantified at a whopping ₹31.36 lakh crore ($385 billion), and therefore any mechanism to resolve and reduce litigation would be a win-win for the government as well as taxpayers.

Additionally, giving upfront clarity to taxpayers would certainly help bring down errors and litigation. More than 90 per cent of the respondents believe that a commentary akin to that of the OECD would be beneficial in providing clarity on positions.

On transfer pricing, which has also been a key area of litigation, the respondents felt that the transfer pricing safe harbour rules should be reoriented to make them more effective. The Finance Minister did announce a proposal to expand the scope of safe harbour rules, which may address this demand of the respondents.

Digitisation of services

With the objective of imparting greater transparency, efficiency and accountability, the government introduced faceless assessment and appeal mechanism. The survey results indicate that the respondents are supportive of this mode of interaction, with only less than 5 per cent wanting to go back to offline mode, which is a great news for the government. However, 60 per cent of the respondents do feel that they would like to see further improvements in the faceless process.

On appeals, about 61 per cent feel that the first appellate process — that is, CIT(A) — be moved out of faceless mode.

While the government had rationalised certain TDS provisions in Budget 2024-25, about 64 per cent of the respondents believe that further simplification of TDS provisions is required. They wanted simplification with regard to allowing TDS credits and the addressing of the mandatory requirement of issuing TDS certificates in all cases.

This time around, the Finance Minister has taken a further step by easing some of the compliances for TDS and TCS provisions.

Interestingly, while one-third of the respondents are happy with the existing corporate tax rates, 58 per cent of the respondents want a further reduction.

The timeline for filing of belated/revised returns has also been an area of concern. Over a period of time, the government has reduced the timeline and currently the due date to file the same stands at December 31 after the end of the year. This leaves very little time, especially for corporates and those who have to comply with transfer pricing requirements, to address any errors or carry out delayed compliances. On this front, 82 per cent of the respondents believe that the timeline should be extended to March 31 of the relevant assessment year.

While the government has taken the first step by rationalising some of the provisions during the previous and the current Budgets, taxpayers should know that not all expectations on simplification of the Act can be brought in immediately, as the government will have to strike a balance between mobilising tax revenue and simplifying the Act.

Mehndiratta is Partner and Head (Aerospace and Defence) at KPMG in India. With inputs from chartered accountants Manan Asri and Sidhant Goyal